My wife and I had decided that we were going to be moving out at the end of our lease and finding a new place to live. Now any apartment complex is likely to pull your credit report — it’s one of the reasons they charge an application fee. So you should be sure of what is on it. And I know my credit history. I knew my credit history before we went applying.

We whittled our list of properties here in Kansas City down to two: The Ethans off Barry Road, and Oakbrook at Newmark off North Oak Trafficway. We liked The Ethans and originally filed application. Then we toured Oakbrook, liked it more, and backed out of The Ethans to file application. Then the day after Memorial Day we got a phone call saying they were denying our application due to my credit history.

Oakbrook went through a company called RealID to get my credit history, which pulled from TransUnion. The Ethans, however, went through a company called SafeRent, which pulled from Experian. The Ethans also gave us a chance to include an explanation of negative marks on our credit report with our application. They approved us relatively quickly.

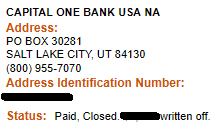

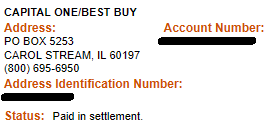

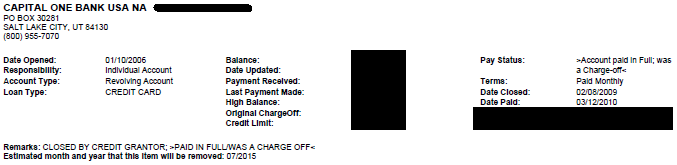

There are five (5) charge-offs on my credit report, and one debt buyer listed that bought one of the charge-offs. All are paid off — the last one was paid off in 2013. Experian reports them as paid very plainly. They still report them as charge offs, but they report them as paid.

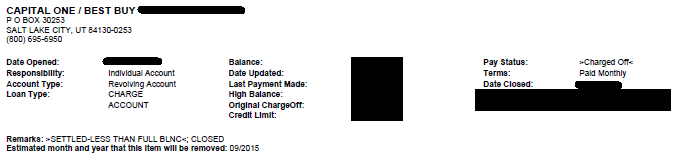

TransUnion doesn’t make it so clear. Well they do for the accounts paid in full, but not for the settled accounts.

The second account listed, the one that was settled for less than full balance, shows a “pay status” of “Charged Off”.

And unless the person pulling the credit report pays attention to the remarks that TransUnion includes with the credit entries — provided TransUnion provided those remarks and the company pulling the report forwarded them — then things look worse than they actually are. The Oakbrook manager kept saying “That’s not what I have on our side” when referring to my assertions that the accounts were paid. The TransUnion report shows in the remarks “PAID IN FULL” where the balance was paid in full, and “SETTLED” where the account was settled. And in the case of the repossession doesn’t have any remark showing the balance is paid off — I’m not planning to correct that, though, and I’ll explain why in a moment.

And if those remarks were with the information that RealID provided to Oakbrook, then the manager was lying to me when he said I’d be approved if I got statements from the creditors showing the charged-off accounts were paid, as he already had the information in front of him showing the accounts were paid or settled.

So TransUnion makes my credit look worse than it actually is. And the Oakbrook manager would not look at the copy of my Experian credit report I had with me when I tried to talk to him. And I’m sure even if I had my TransUnion report with me (I debated on taking it as well but didn’t), it likely still would’ve been ignored: “That’s not what I have on our side”. I don’t know what information they had, and they wouldn’t provide specifics, not to me directly and not in the rejection letter. I really wish he did instead of constantly being so cryptic.

Here’s what makes this all the more disheartening.

Four (4) of the charge offs, including the debt buyer, are estimated to fall off my credit report in July, as in less than two months from when I write this. The other two, one of which is the repossession, fall off in September. Had our lease been expiring later this year instead of at the end of July, my credit report would’ve looked almost as clean as my credit actually is.

Had RealID pulled Experian instead of TransUnion, or the manager considered my Experian report when I brought it in, I probably wouldn’t even be writing this article. Instead I’ve got a money order for the security deposit I need to try to get refunded, and we’re going to be signing another lease at our current apartment complex.

You must be logged in to post a comment.