One idea commonly parroted by those who are anti-abortion or “pro-life” is the idea that the “abortion industry” is targeting minorities, particularly blacks. It is certainly a persistently pressed idea, and there are entire organizations that exist just to perpetuate this claim. Indeed an entire organization exists saying that abortion is “black genocide”.

And when you have an agenda and you find facts that can be twisted to be in support of that agenda, it is easy to take things a little too far and say things that are not true. I’m certainly guilty of this myself, though I feel I’ve been getting better at this over time.

Now anyone who thinks that abortion is a black and white issue (no pun intended) is not thinking things through. It is a complicated issue with many different facets. But all ideas originate somewhere, and I believe this idea is derived from several claims.

Claim #1: Black women have more abortions

The first claim is simply this: the abortion rate among minorities is significantly higher than among whites. After all, if this were not the case, the “pro-life” crowd would not have any leg to stand on with regard to the general idea that the so-called “abortion industry” is targeting minorities.

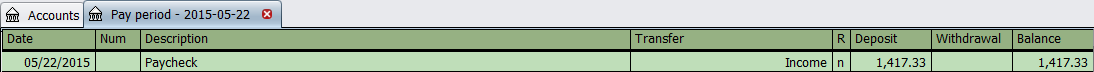

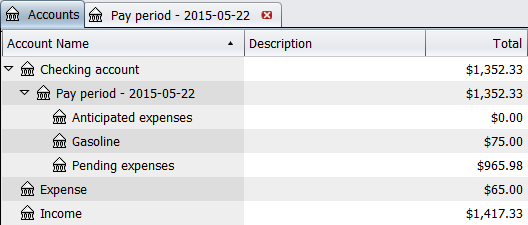

Earlier in 2016 the Guttmacher Institute published a revision to their “Facts on Induced Abortion in the United States” report showing the demographics of abortion patients for 2014. The breakdown on abortion rates by race shows this:

So black women account for about 28% of all abortions. That’s a pretty big number given that according to census reports, those who are black account for approximately 12.6% of the population according to the 2010 census. And if we presume an even distribution of men and women, that means that 28% of abortions are obtained by 12.6% of women.

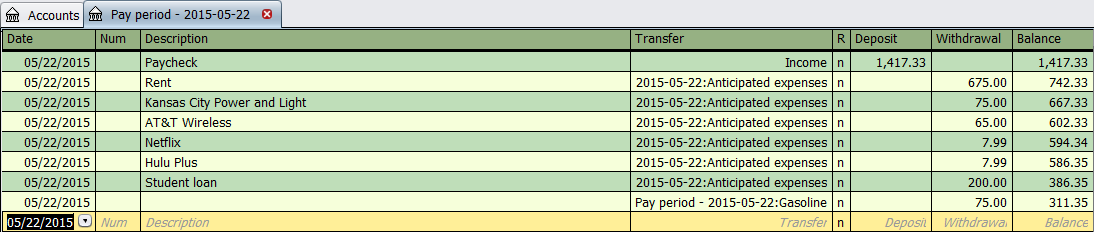

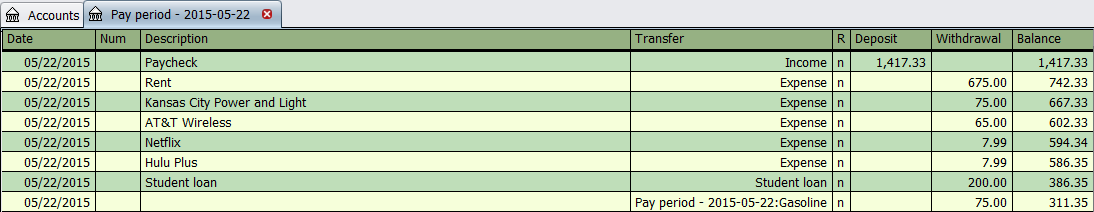

According to the United States Centers for Disease Control and Prevention, here are the various pregnancy statistics for all women in the United States for 2008 (per 1,000 women aged 15 to 44 years old):

Overall about 18.4% of all pregnancies in 2008 were terminated via abortion. The lowest abortion rate is among white women, with about 1 in 8 pregnancies being terminated. Next lowest is the rate among Hispanic women, with a little over 17% of pregnancies being terminated. And the rate among blacks is the highest, with approximately 36% of pregnancies being terminated, over 1 in 3.

Looking at the overall numbers between racial groups, we can see that the abortion rate for Hispanics is about 2.5x that of white women, while the abortion rate for black women is almost double that of Hispanic women and almost 5x that of white women. This despite the fact the pregnancy rate for black women isn’t even double that of white women — 144.3 and 87.5 per 100,000 respectively. What could explain that disparity?

That question will be addressed later.

Claim #2: Most abortion clinics are in “black neighborhoods”

The second claim that is commonly provided by anti-abortion organizations is the idea that the majority of abortion clinics are in areas predominantly patronized or occupied by blacks, so-called “black neighborhoods”. The Guttmacher Institute recently evaluated this claim and published a report on it. They summarize the claim as

Antiabortion activists often claim that most abortion clinics are located in predominantly black neighborhoods. However, this claim—offered as supposed proof that abortion providers “target” African-American women—is never documented.

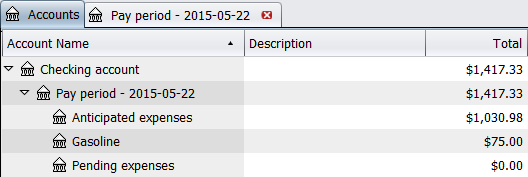

According to the report, a majority of clinics providing abortion services are located in areas or neighborhoods predominantly occupied by non-Hispanic whites. Here’s the breakdown based on which ethnicity accounts for the majority of the population in a given area around the clinic:

So 15% of clinics are in neighborhoods or areas where there is a significant mix of ethnicities within the population. These clinics could be in non-residential areas as well, but most clinics are in areas where the population is dominated by non-Hispanic whites.

Claim #3: Cascading argument – Abortion = racism, eugenics

This last claim I’m going to call the “cascading” argument because the argument starts with several premises and results in a conclusion, the conclusion being the argument that is attempted. The argument can typically be phrased as this: Planned Parenthood performs more abortions than any other abortion provider, Planned Parenthood was founded by Margaret Sanger, Margaret Sanger supported eugenics, eugenics called for the extermination of blacks and other “lesser” races, therefore abortion is racist or a form of eugenics.

I’m unsure if this is circular reasoning or an attempt to make a slippery slope argument, but that’s a technicality that is immaterial. This argument basically asks or demands the person hearing it to accept the argument without knowing all the applicable facts. The connection seems reasonable on the outset, but breaks down under scrutiny with only a modicum of critical thinking.

Planned Parenthood was founded by Margaret Sanger. Planned Parenthood started as a small birth control clinic in 1916. At the time, dispensing birth control was a crime in the State of New York, and in much of the United States, and Sanger was jailed for doing so. The clinic was reorganized in 1921 to be a member of the newly-formed American Birth Control League, which was organized at the First American Birth Control Conference in New York City that year, but was officially incorporated under the laws of New York in 1922.

In 1942 the league reorganized to become the Planned Parenthood Federation of America, and it is one of the most familiar names in women’s reproductive health services.

Margaret Sanger was a supporter of eugenics, but so were a lot of people 100 years ago. Like slavery, eugenics was once a popular idea that is now seen as abhorrent. Many have accused that Charles Darwin was a supporter of eugenics by way of his published theory of evolution, but the concept of eugenics originated with Darwin’s cousin, Sir Francis Galton, and Darwin wanted nothing to do with it and did not support the idea at all. Eugenics is a bastardization of the concepts inherent to Darwin’s concept of evolution. Its most prominent practitioner was easily Adolf Hitler, though the concept was supported by the likes of Winston Churchill, Theodore Roosevelt, John Maynard Keynes (after whom is named Keynesian economics), and George Barnard Shaw.

The concept of eugenics is in wide practice today, just not on human populations. Instead eugenics is practiced with animal populations, especially that of horses, cattle, dogs, and cats, among others. Basically wherever artificial controls are exerted over the act of reproducing – i.e. by controlling with whom a subject mates or even employing artificial insemination – you have a form of eugenics.

But while Sanger was a eugenicist, one has a lot of evidence to uncover to support the idea that abortion is either inherently racist or a form of eugenics. For starters, the medical concept of induced abortion predates much of modern medicine and the concept of eugenics by millennia, with the earliest evidence of induced abortions being dated back to 1550 BC in Egypt. The Chinese practiced it as far back as 500 BC, but Chinese folklore dates abortions back approximately 5,000 years.

All of this being true, Sanger’s views on eugenics are immaterial to the modern practice of abortion. The two are not and cannot be linked. This is especially true given that overall, based on raw numbers, the plurality of abortions are not obtained by blacks, but by whites, as explained in the evaluation of the first claim. It’s about like finding one person at a technology company who is a member of the KKK and then saying the entire organization is racist as a result. Talk about a leap of faith, to say the least.

Further Sanger’s focus was on birth control, not abortion. Sanger’s own writings show that she did not support abortion, calling it a “disgrace to civilization” and saying that birth control was a “cure for abortions”.

Intermission

One point I want to make very, very clear: I am not arguing in favor of abortion, only trying to counter one of the loudest claims made by those who vehemently oppose abortion – basically putting the numbers to the claim to see if there is any merit to it. Fronting a claim that has not been demonstrated to be true just because it sounds good is dishonest, and plenty of people on the pro-life side of this debate are dishonest. This is not to say that there is no one among those considered “pro-choice” that is dishonest as there very likely are.

But let’s summarize the three claims above.

The percentage of abortions obtained by blacks exceeds their representative proportion in the population of the United States, with the former being about twice the latter, and the rate of abortions based on population among blacks is about 5x that among whites.

This does not, on it’s own, mean that the abortion industry is targeting minorities. It’s a disingenuous explanation: blacks are having abortions at a higher rate, so the abortion industry must be targeting blacks.

Further, the pregnancy rate among blacks exceeds the overall pregnancy rate of whites by a significant margin. This alone leans very heavily upon the real explanation of why the abortion rate among blacks is so high. More pregnancies means there will be more abortions. But is it really that simple? Not quite. As we shall see when I attempt to explain in detail why the abortion rate among blacks is much higher.

At this point, being honest requires us to dismiss the claim that the abortion providers are targeting blacks. There is no evidence to support it. While there is evidence suggesting it – such as the vastly higher abortion rate – that evidence has alternate explanations and does not support the claim in exclusion of other possibilities. Unless there is hard evidence that minorities are being targeted directly by abortion providers, that claim must be dismissed.

From here, let us proceed to see if we can explain why blacks have more abortions by examining various counter-claims to the main idea. The explanation is, to say the least, rather complex. From there we should be able to come up with a comprehensive and data-supported method of reducing the abortion rate, among blacks and overall, that will have more success than simply banning it.

Counter-Claim #1: Higher rates of unintended pregnancies

There is a very strong correlation between unintended pregnancy and abortion. Given the high abortion rates among blacks and Hispanics, established above, it is reasonable to predict that such a correlation is to be reflected among blacks and Hispanics.

First, this is a breakdown of the total percentage of pregnancies among whites, blacks, and Hispanics that are unintended for 2011:

Overall about 45% of pregnancies were unintended in 2011, down from 51% in 2008. And while high at 64% among blacks, that’s down from a near 7 in 10 unintended pregnancy rate for 2008.

So among blacks, there are about 2 unintended pregnancies for every intended pregnancy, while nearly the opposite among whites. Even among Hispanics, about half of pregnancies are unintended, but Hispanics account for only 1 in 4 abortions. Taking these percentages and applying them to the “overall” number above reveals the rate of pregnancies that are unintended (per 1,000 women aged 15 to 44):

So in 2011 about 1 in 10 black women of reproductive age became unintentionally pregnant. Let that number sink in a little. And that number is just shy of triple the unintended pregnancy rate for whites, with the unintended pregnancy rate for Hispanic women being more than double that of white women.

But do these numbers explain why the abortion rate among blacks and Hispanics is significantly higher than among whites? Not entirely.

First, we need to determine why blacks and Hispanics are becoming pregnant unintentionally at a much higher rate. Only two predictions can be made from this, and they work in tandem: they are more sexually active and/or less likely to use contraception consistently and correctly.

Counter-Claim #2: More sexually active

Recall from above that blacks became pregnant at a rate of 144.3 per 1,000 women in 2008 compared to 87.5 in 1,000 white women. That’s about a 65% higher rate. Even among Hispanics the pregnancy rate was about 56.5% higher than among whites — 136.9 in 1,000 compared to 87.5 in 1,000. Higher pregnancy rates infer more sexual activity.

The United States Centers for Disease Control and Prevention publishes on a bi-annual basis a report regarding risky behaviors among high school students as part of the Youth Risk Behavior Surveillance System. As of the time of this writing, the most recent statistics available are for 2015. The data are viewable online, and a nice interface for filtering the data is provided, so I encourage you to take a look at the web site and look at the data for yourself. If you notice any disparities in the data versus what I provide here, I welcome the feedback.

The data are provided with overall numbers and numbers for males and females. For the most part, I will be looking only at the overall numbers. Let’s look at a few key numbers. Among surveyed students, the percentages reporting having ever had sexual intercourse are (95% CI):

So the overall numbers are pretty well in line with the pregnancy and abortion numbers. Overall the highest rates of pregnancy, unintended pregnancy, and sexual activity are among blacks, with Hispanics still higher than whites but less than blacks.

Now these sexual activity numbers are for high school, and the percentages do converge more in the higher grades but never cross. And it’s reasonable to presume that sexual activity among blacks will remain higher than among whites and Hispanics even in adult years.

This is especially true when talking about the number of respondents reporting having had sex before age 13. According to the survey, 8.3% of surveyed black high school students reported having sex before the age of 13, compared to only 5.0% of Hispanic high school students and 2.5% of white high school students.

And 13% of surveyed black male freshmen and 4.3% of surveyed black female freshmen reported having 4 or more sex partners in their life. At senior high school grades, the numbers jump to 46.1% of surveyed black men and 20.1% of surveyed black women report having 4 or more sex partners. For whites at the senior grade, it is 18.2% of surveyed men, and 16.8% of surveyed women. For Hispanics at the senior grade, it’s 23.5% of surveyed men and 12.8% of surveyed women.

All of this means exposure to a higher risk of unintended pregnancies not only during high school but also later in life unless their ways change.

Counter-Claim #3: Less likely to use contraceptives or use them properly

The sexual activity statistics alone do not account for the high rate of unintended pregnancies among blacks and Hispanics. There must be a complementary factor, and the only complementary factor is a lack of proper contraceptive use.

Given the overall pregnancy rate among teens aged 15 to 17 was 39.5 in 2008, with about 1 in 4 of those ending in abortion, that’s a likely factor. The pregnancy rate among blacks aged 15 to 17 in 2008, however, was 72.8 in 1,000. And the abortion rate was 26.7, meaning over 1 in 3 pregnancies among black teens aged 15 to 17 ended in abortion.

The data from the CDC Youth Risk Behavior Surveillance System does not appear to support this notion among high school students, at least in overall statistics. But the one thing to bear in mind is that these statistics are among high school students. Further the question that is asked is whether they used a condom during their last sexual encounter. The question about birth control does not ask how long the student had been using it, or whether they were complying with the administration instructions, only if they were self-administering it at all.

But one thing that is of note: condom use among black students is negatively correlated with age, with more 12 grade black students reporting they did not use a condom than 9th grade black students. Again, though, the question is about their most recent sexual encounter, and does not attempt to determine whether that use was consistent or even correct.

In November 2015, the CDC published an analysis of contraceptive use for 2011 to 2013 in the United States among women aged 15 to 44. It showed that about 6.9% of respondents reported having had intercourse within the 3 months preceding the survey while not expressing any desire to become pregnant.

The survey reported that 61.7 women were actively using contraception. This doesn’t mean they are using it consistently or correctly. Blacks are slightly more likely to rely on condoms and the withdrawal method, slightly more likely to use the patch or ring, but 40% less likely to use either the pill or intra-uterine device (IUD). Blacks also get the intravenous contraception (Depo-Provera) at over 3x the rate of whites.

Among overall contraceptive usage among all race classifications, the percentages reported for blacks were the lowest at 54.5%. Contraception usage among whites the highest at 64.7% of respondents.

In 2014 the CDC published a data brief from the 2013 National Survey of Family Growth that included contraceptive use among interviewees. Several findings are key:

- Contraceptive use was higher among women aged 25 or higher compared to women aged 15-24

- White women were more likely to use contraception (65.3%) than blacks (57.9%) and Hispanics (57.3%)

- 6.9% of women between 15 and 44 who are sexually active do not employ contraceptives

- Education level had little impact on contraceptive use

- Condom use among 15-24 and 25-34 age ranges was similar, but lower in the 35-44 age range. Race was not a factor in determining condom use.

In a special tabulation, the National Center for Health Statistics determined that that shy of 1 in 4 women surveyed (24.3%) used a condom at their most recent sexual encounter. The condom was still the leading choice for contraceptive use for first intercourse, but for established sexual relationships appeared to not be preferred. It’s overall use among women surveyed was about 9.4%.

Less than 1 in 5 women and less than 1 in 4 men report using a condom every time they have sex.

Back in 2010 the CDC published another study regarding contraceptive use that followed several different time frames, the most recent being 2008. That study noted that slightly over 1 in 10 women who responded to the survey who were at risk for an unintended pregnancy were not using any form of contraception.

Among age breakdown, that number becomes 18.7% for women aged 15-19 years, 14.3% for women aged 20-24 years, and 11.9% for women aged 25-29 years. Among women with no high school diploma, non-contraception use among women at risk for unintended pregnancies is at 11.9%, with that rate dropping to 9.3% for women with a high school diploma, 9.1% for women with less than a bachelor’s degree, and 8.2% for women with a bachelor degree or higher.

Further, women below the poverty line are most likely to not use contraception: 12.6% of at-risk women between 0% and 99% the poverty level income don’t use contraception. Overall of women under 150% their poverty level, the percentage of non-contraceptive use is 12.3%. This drops to 10.3% for women between 150% and 299% poverty level, and drops to 7.9% for women at or above 300% poverty level.

And going back to race, the numbers again are quite telling. Among black women, 16.3% of black women at risk for an unintended pregnancy did not use contraception, while the percentage among white women was only 9.4%. For Hispanic women, the percentage was 13.8%.

This, however, begs another question: why is contraceptive use lacking when they wish to prevent pregnancy? The survey asked women who became unintentionally pregnant as to why they did not employ contraception. The results showed that 43.9% of women were not aware they were at risk for a pregnancy, while 16.2% of the women were concerned about side effects from the contraception – makes me wonder what kind of contraceptive methods they considered employing.

Here’s a startling number: 16.9% of the women who responded said their male partner didn’t want to use contraception. Another one: 14.1% of the women responded said they didn’t expect to have sex. So overall we have a general problem of both men and women not really understanding how female fertility and contraception works so they know best how to avoid pregnancy when they want to.

Further the numbers clearly show that blacks are less likely to employ contraception than whites, and slightly less likely than Hispanics. Those who are younger and at risk for an unintended pregnancy are also less likely to employ contraception. And women who are at or below the poverty line are also less likely to employ contraception, as are women who are lesser educated.

So young, undereducated, impoverished black women seem to be the least likely to use contraception given the numbers. And given the rate of unintended pregnancies, they are also significantly more likely to not use it properly when they are at risk of becoming pregnant and want to prevent it.

Counter-Claim #4: More black individuals live below 200% of the poverty definition

According to the United States Census Bureau, here is the poverty breakdown in the United States for 2010 by race:

Now the definition of “poverty” varies based on household. The government definition of what constitutes the poverty threshold is determined by the Census Bureau. A person who lives alone is considered impoverished if their annual income is less than $11,344 for 2010. The poverty level for a single parent with a child is $15,030, and the level goes up incrementally based on the size of the household, and the threshold is determined based on a calculated cost of living.

So a single person living alone is at 200% the poverty threshold when they have an annual income of $22,688 – the equivalent of an hourly wage of $10.90 for a 40-hour work week.

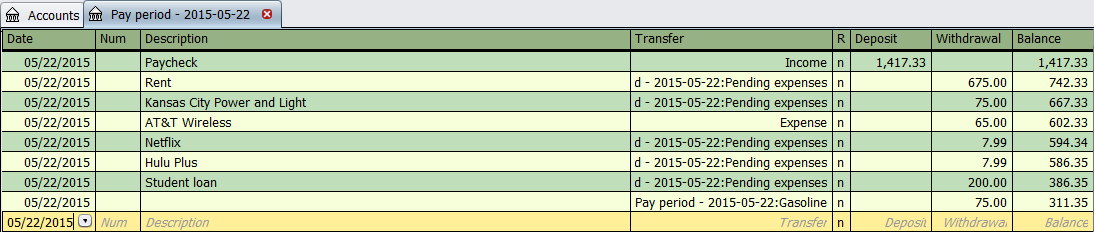

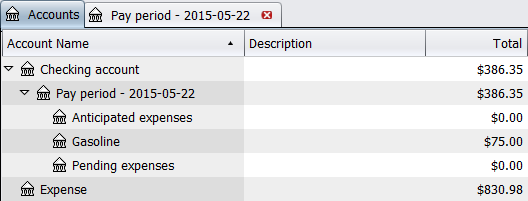

There is a clear correlation between poverty and abortion. Those below the poverty line are significantly more likely to obtain an abortion when there is an unwanted pregnancy. The majority of abortions are obtained by women living below 200% the definition of poverty for that individual. This according to the Guttmacher Institute:

According to the data 75% of abortions, 3 in 4, were obtained by people living below 200% the poverty definition, with almost half of all abortions obtained by individuals living at or below the definition of poverty. Using the 2008 figure of 1.2 million abortions, that’s 600,000 abortions obtained by individuals at or below poverty, with another approximately 312 thousand obtained by individuals living above the poverty level but below 200% the level of poverty. That is a significant number unto itself.

So let’s summarize the data for this claim:

- shy of half of all abortions are obtained by women meeting the Federal definition of poverty

- another 1 in 4 are obtained by women between 100% and 199% the Federal definition of poverty

- the poverty rate among blacks is more than 2 ½ times that among non-Hispanic whites

So poverty is clearly correlated with the rate of abortions. And blacks and Hispanics are more likely to be impoverished than whites. And blacks and Hispanics are more likely to become unexpectedly pregnant, and more likely to terminate that pregnancy via abortion.

Conclusions

The data do not support the claim that the so-called “abortion industry” is targeting minorities. There is no “black genocide” with regard to abortion, and in particular with regard to Planned Parenthood.

While clear that blacks do have the higher incidence of abortion, and they are seeking abortion services at a higher rate than other ethnicities, they also have a much higher rate of unintended pregnancies – almost 2 in 3 pregnancies among blacks are unintended. The rate of unintended pregnancies is so high because blacks are more sexually active and less likely to use contraceptives in a consistent and correct manner. The unanswered question being why.

So if they are having a much higher rate of unintended pregnancies, it is reasonable to presume that they will seek abortion services at a higher rate, especially given that blacks are more likely to be living below the poverty line. Half of all abortions are obtained by women living at or below the poverty line, with overall 3 in 4 abortions obtained by women living below 200% poverty definition.

Contrary to seemingly popular belief among anti-abortion activists, the majority of abortion clinics are not in areas predominantly frequented or occupied by blacks. That fact alone casts serious doubt to the claim the “abortion industry” is targeting blacks.

To support the claim that the “abortion industry” is targeting blacks for “black genocide”, you must demonstrate that abortion providers are

- encouraging blacks to be more sexually active, and to become sexually active at a younger age

- discouraging blacks from consistently and correctly using contraception to prevent pregnancy, such that they become unexpectedly pregnant

- encouraging unexpectedly pregnant black women to seek abortion services rather than carrying the pregnancy to term

The explanation that the “abortion industry” is targeting blacks is without evidence, and without merit. There is plenty of evidence supporting contrary explanations. To put it simply, without hard evidence of direct marketing or targeting of blacks by abortion providers, the claim can be shown by the numbers to have no merit at all.

Reducing the number of abortions

Many pro-life organizations would have you believe that outlawing abortion is the solution to the issue of abortion, as if the law will operate like some magic spell and cure that issue. Except the world, unfortunately, doesn’t work that way.

Reducing the total number of abortions performed each year requires reducing the total number of unintended pregnancies. This can come about in several ways. And we can start by teaching minors in school about proper contraceptive use while encouraging it among teens who are sexually active. Further abstinence needs to be promoted, as abstinence is the only 100% guaranteed way of preventing pregnancy and the contraction of an STD.

But abstinence-only education programs, however, will not help solve the problem, and there is reason to believe it will only exacerbate it.

Along with this, we need to understand why contraceptive use among sexually active blacks appears to be so lacking. What can be done to encourage responsible sexual activity?

But this is only one side of the coin and will not solve the problem entirely.

If you really want to deal a blow to the number of abortions in the United States, the one critical way to do so is by lifting minorities out of poverty. We need to foster the kind of economic environments in which prosperity and wealth flourish. “Wealthier is healthier,” John Stossel has said on his program on the Fox Business Network. And so too a wealthier, educated population is significantly more likely to use contraceptives consistently and correctly. They are less likely to become unintentionally pregnant. And they are less likely to have abortions than their impoverished counterparts by significant margins.

* * * * *

You must be logged in to post a comment.